How to get started investing into Bitcoin as a company and navigate tax considerations

Emanuel Coen

almost 2 years ago ·

14 min read

In the past few months we have seen a new narrative emerge. A narrative of institutions & corporations showing increasing interest for bitcoin and other cryptocurrencies. The recent mega bitcoin purchases by Square ($50m dollars) and MicroStrategy($435m dollars) certainly made global headlines and brought this to the light for everybody. Under the surface however, this trend started much earlier during the frosty bear market of 2018.

Top-tier VC firms like Andreesen Horrowitz (a16z) doubled down on their crypto bet while half the world had lost its interest in crypto and closed two dedicated crypto funds totalling over $815 million dollars of capital commitments. Equally famous is the story of Paradigm, which convinced top institutional investors like Harvard and Stanford to give them $750 million to invest in a market they were too blue-blooded to touch directly. Paradigm then invested the full amount of its initial capital in Bitcoin and Ethereum in 2018 at burst-bubble discount prices.

Needless to say these investments have paid off. Bitcoins and Etherum’s value have more than tripled since Paradigms and a16z’s investments. MicroStrategy’s bitcoin investment is up $100m since the time of purchase a month ago. And the space has won unlikely new allies: billionaire Paul Tudor Jones, announced he was buying Bitcoin as a hedge against inflation in May; major institutions including J.P. Morgan, Mastercard and Visa, all of which announced crypto plans over the summer.

Why should companies invest in crypto?

As a new asset class, Bitcoin took time to build a price history and some sense of the cycles it goes through. Today, crypto’s value proposition is better understood by most sophisticated investors and seen as a welcome asset to expand and diversify their largely fiat-denominated balance sheets. Moreover, given the negative interest rate environment that we’re currently in, holding cash has become expensive for companies. Investing into bitcoin and other cryptocurrencies appears therefore like an increasingly rational choice.

Bitcoin as a store of value ( a.k.a “digital gold”)

One of the primary functions of money is to be a store of value: a mechanism to transfer purchasing power across time and geography.

Gold has been trusted as a store of value for millennia. The primary reason for gold’s status as a store of value is that the supply of gold on Earth is scarce. Confidence in its store of value qualities rests in humanity's understanding of nature: that gold is limited and cannot yet be cost-effectively synthesized.

Well established fiat currencies like the US dollar or the Euro can also be thought of as good stores of value. Confidence in fiat currencies rest on trust in the government (e.g., to wisely manage their monetary policy). There is great efficiency in placing such trust in a single institution, but there is also risk. Fiat currencies can lose credibility and be devalued through the actions of the government, who in times of crisis may face short-term pressures that outweigh concerns for long-term credibility.

Contrasting these two stores of value, we can think of the US Dollar as a centralized monetary asset, which can be devalued by a single actor, and gold as a decentralized monetary asset, which cannot.

Now Bitcoin shares this and many other characteristics with gold. Like gold, Bitcoin has a finite supply. Currently the supply of Bitcoin is close to 19 million. Over the course of its lifetime it will asymptomatically approach 21 million. Achieving scarcity in digital form was Bitcoin's great technical breakthrough (building on decades of computer science research). Arguably, Bitcoin is even more scarce than gold as gold’s total earth supply can only be guessed - not known for certain. New discoveries keep making the news (Elon Musk even wants to mine gold on Mars!).

Moreover, like gold, Bitcoin is hard to mine. In the Bitcoin network miners have to put computing power to use in order to validate transactions. The process is both hardware and energy intensive.

However, unlike gold, bitcoin is digital, portable and censorship-resistant. The fact that it’s digital means that it is cheaper to store and easier to transfer than gold, which is physically cumbersome. These properties are especially useful in times of capital controls or expropriations where Bitcoin can not be seized as the currency is transferred over a peer-to-peer network and held in private bitcoin wallets unattainable by anyone but the owner holding the private keys.

To conclude, Bitcoin bears many similarities with gold but also possesses a number of qualities that physical gold doesn’t have. Qualities that are increasingly valuable in a digital first and globalized world. The difference is mainly that Bitcoin is newer and with a smaller market capitalization, with more explosive upside and downside potential. A so-called asymmetric bet.

How to buy Bitcoin as a company?

If you’ve never bought bitcoin or other cryptocurrencies before this question might be daunting. Where do you buy bitcoin, how do you do it and where do you store it?

The most common method to buy bitcoin is to buy it on a cryptocurrency exchange. Just like any traditional brokerage account they let users transfer funds into the account by bank transfer and place orders on their order book.

1. Sign-up for a corporate crypto exchange account

The first step that you have to undertake to buy bitcoin as a company is to sign-up for a cryptocurrency exchange offering dedicated corporate accounts like Gemini, Kraken, Coinbase or River. This is important because in many legislations around the world it is a lot more complicated to let “others” buy assets under the company’s name.

Opening a personal account and trading in the name of the company is therefore not a good idea and could significantly complicate your tax declaration and open up new tax problems regarding your crypto assets. Additionally, in most cases you will enjoy higher funding limits and better customer support than you would with a personal account.

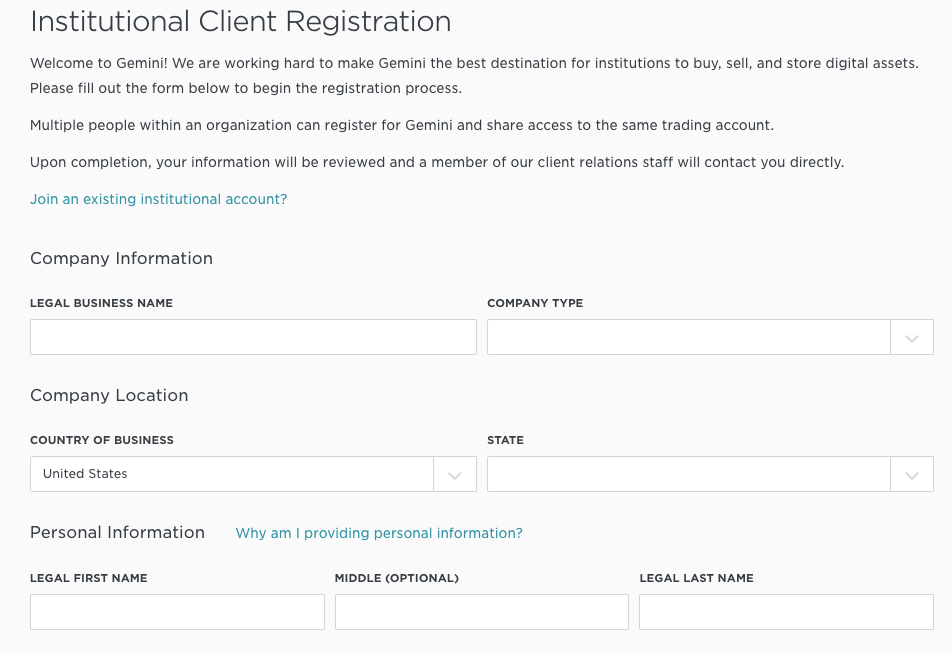

Institutional account sign-up on Gemini.com

2. Buy bitcoin

The second step to buy bitcoin as a company is to actually place the order. First, you need to transfer funds (euros, dollars, pounds etc.) from your corporate bank account to the exchange. Some business bank accounts block transfers to and from crypto exchanges so you might want to inquire about your banks’ stance towards crypto exchanges beforehand.

Once the funds have arrived on the exchange, you have to place your order. Generally speaking, there are two types of orders. If you want to simply buy at the current bitcoin price you submit a ‘market order’ (easy) and if you want to buy at a specific price you submit a ‘limit order’.

Market orders vs. Limit orders

When you submit a ‘market’ order, the exchange looks at the current sell orders on the orderbook and calculates the price at which your buy order will be automatically filled. As a user, you only have to enter the amount you want to buy and press on the “buy” button.

Pros: Easy, Convenient.

Cons: Expensive for large amounts. You will probably see the price rise as your order gets executed. This is due to the fact that once you finish buying from the “cheap” sellers, you gradually move to the “expensive” sellers. This means you don’t have a fixed price for your purchase.

On the other hand if you manually create a ‘limit order’, you are indicating the price at which you’re willing to buy, you are creating a new order on the orderbook. Once there is a corresponding sell offer your order will be “filled”.

Pros: More control, fixed price good for buying large amounts

Cons: Your order might never be filled if market prices move up and your bid is too low.

There is a third option available if you’re interested in buying high amounts of bitcoin (> $100,000), which is to turn to an OTC desk. Imagine an OTC desk a bit like a concierge or VIP service allowing you to place a custom order and fixing a price beforehand. In this case the trade is not settled on the orderbook but in private. Most crypto exchanges have an OTC desk in-house but there are also specialized OTC desks like Genesis which are only focusing on institutional clients and don’t serve any consumers. Many institutional buyers like OTC desks as they prefer to stay private and get their orders fulfilled fast. When you use an OTC desk you can call or email your contact person and negotiate a fixed price (e.g. “Bitstamp rate + 1%”).

3. Keep your bitcoin safe

Once you acquire some bitcoin on an exchange you have two options for storing them.

1) Third party custody: leave them in the custody of the exchange where you bought them

2) Self-Custody: withdraw them from the exchange and store them in your own bitcoin wallet

What’s the difference between third party and self-custody you may ask? One of the breakthroughs of cryptocurrencies such as bitcoin is that users can truly self-custody their digital assets. Users hold their bitcoin in a bitcoin wallet which manages the users’ private key and is responsible for signing transactions. Before adding a new transaction to the Blockchain, bitcoin miners check that the transaction is signed by the valid private key belonging to the bitcoins in the transaction. This is why bitcoin is more like cash and less like a digital dollar in a bank account which is just an IOU, a claim to receive a real dollar from the bank when requested. With bitcoin, there is no middleman between users and their assets.

However, the freedom that bitcoin brings also bears some responsibility. When the private key is lost, no one can recover the funds for you simply because there is no third-party storing a backup for you. While the funds are still on the blockchain, the ability to move and control them is lost the minute the private key vanishes. Especially in the early days of bitcoin people lost significant amounts of money this way.

If you opt for self-custody the best option to keep your company’s bitcoins secure is to get a bitcoin hardware wallet. A hardware wallet is a little device that keeps your private keys offline and thus removes most attack vectors for hackers. Whenever you want to send bitcoin, you connect your hardware wallet to an app on your computer and use the hardware wallet to sign transactions in combination with the hardware wallet app.

For those that don’t want this responsibility, there’s always the option to leave the bitcoins in the custody of the exchange where you bought them. Top-tier exchanges have invested millions in the security of their storage systems as it is the core piece of their infrastructure. In addition, many of the top-tier crypto exchanges have insurance policies in case they get hacked. However, before you decide to go down this route analyze the security page of the crypto exchange you’re considering to get a better picture of their security measures. There have been numerous events where low-security offshore crypto exchanges got hacked. Don’t compromise on your safety and find a crypto exchange with a clean track record.

What are the tax implications of holding bitcoin as a company?

As cryptocurrencies become a widely accepted store of value, taxing authorities around the world have responded with varying taxation requirements. Every country has their own specific tax code which will apply to companies domiciled under their jurisdiction. Although there is still much grey area in cryptocurrency tax regulations, It’s becoming increasingly more important for companies to understand the taxation rules and regulations that apply to cryptocurrency transactions in their jurisdiction. For illustration purposes, we’ve provided a comparison of relevant tax guidance in the USA, Germany and the UK.

USA

American corporations looking to invest in Bitcoin must first consider the tax implications. Simply purchasing Bitcoin for USD or another fiat currency does not represent a taxable event. There are other financial reporting considerations that must be taken into account when a corporation holds Bitcoin for investment purposes.

Taxable Events

A taxable event occurs when Bitcoin is sold for USD or another fiat currency. The IRS has issued current tax guidance in Notice 2014-21 as guidance for individuals and businesses on the tax treatment of cryptocurrency transactions. The guidance treats cryptocurrencies as property, and therefore, the applicable tax principles that apply to property or barter transactions apply to transactions of cryptocurrencies. There are also state specific rules around crypto transactions - so be sure to consult with a local tax professional.

Tax Liability

The amount of tax liability on Bitcoin transactions is dependent on the amount of gain or loss recognized. A capital gain occurs when you sell Bitcoin for more than you paid to acquire it (capital gain = sell price - cost basis). The cost basis is the amount you spent in USD plus any fees, commissions and other acquisition costs to acquire Bitcoin. If the cost basis exceeds the selling price, a loss is recognized.

Corporations can offset gains with losses for tax purposes. Corporate net capital gains are added to the Corporation’s ordinary income and taxed at ordinary rates. If the total capital losses exceed the total capital gains, those losses cannot be deducted in the current year. The excesses losses are carried back up to three years and then forward for a period of 5 years to only offset capital gains.

Tax Reporting

Sales of cryptocurrencies should be reported on your tax return using Schedule D and Form 8949. You'll show your capital gain or loss calculations right on the form, per instructions.

This section is provided by Maria Okeke Director of Finance at River, a US bitcoin exchange with a special focus on institutional clients.

Germany

For a German company who is considering having crypto as an investment, there are some tax implications they should know about. The difference between private and business assets are very big. All the things you might have heard, like tax free after one year do not apply for business assets.

Taxable Events

Germany does not have the concept of a taxable event for business assets. A German business needs to do their accounting with these assets. Every transaction needs to be reflected in the accounting. So no matter if this is a buy or sell there needs to be some reflection in the companies accounting. The profit and loss will then be calculated by the end of the year based on the overall properties of the company in the balance sheet.

For cryptocurrencies to be included in a balance sheet, they must represent an asset due to the principle of completeness from § 246 para. 1 sentence 1 HGB. The German commercial law leaves open which characteristics a right or property must exhibit, in order to be able to be classified as an asset. In the meantime, however, it has been widely recognized that the essential characteristic for classification is the criterion of individual saleability.

Under which section in the balance sheet an item is listed is important for the evaluation of an asset. Only the item "other assets" remains as a disclosure option in the current assets due to the lack of currency and securities properties in accordance with § 2 Paragraph 1 of the German Securities Trading Act (WpHG). Such a disclosure is obvious because gold and silver coins, for which a cash characteristic is also denied, are also to be disclosed here.

Tax Liability

The tax liability depends on the value the assets have in the balance sheet. All cryptocurrencies are generally accounted for according to the strict lowest value principle.

Of three possible values, the acquisition or production costs, the stock exchange or market price and the value to be attributed on the balance sheet date, the lowest value is always to be applied to current assets. Valuation according to the lower of cost or market principle means that, unlike unrealized gains, unrealized losses are reported.

Tax Reporting

The crypto currencies have to be reported as part of the balance sheet. As always all transactions have to be documented and kept ready for potential requests of the tax office.

This section is provided by Werner Hoffmann founder of Pekuna a German firm specializing in all aspects around taxation and reporting of crypto currencies.

UK

Cryptocurrency industry and the underlying technology and the uses of cryptocurrency growing at a rapid pace. Therefore, the accounting and tax treatment has also had to develop to ensure appropriate compliance and reporting. On 1 November 2019, HMRC published guidelines relating businesses undertaking cryptocurrency transactions.

Taxable Events

A UK based company pays corporation tax on profits it makes from:

- Doing business (Trading profit)

- Investment income and gains (Loan Relationship)

- Chargeable gain on disposal of assets. (tangible and intangible)

If the company held cryptocurrency as part of the existing trade, then the profit will be included in the trading profit. Cryptocurrency is not considered a currency in the UK. In addition, there is typically no counterparty to the cryptocurrency transactions, therefore the investment in cryptocurrency does not fall within the loan relationship rules. A company has a ‘loan relationship’ if it has a money debt that has arisen from a transaction for the lending or borrowing of money.

Cryptocurrency is considered as an intangible asset, therefore considered a chargeable asset for tax purposes in UK, as it meets the following two criteria:

- it is something which is capable of being owned and

- it’s value is capable of being realised.

What this means is that, if the company held cryptocurrency as not part of trade, but as an investment, then the disposal of the cryptocurrency will give rise to a chargeable gain/loss.

Tax Liability

If the company makes a chargeable gain from cryptocurrency disposal, it does not pay capital gains tax, instead the company pays corporation tax (19% based on the tax rate for fy2019-20 tax year). A ‘disposal’ is a broad concept and includes:

- Disposal of cryptocurrency for money

- Exchanging cryptocurrency with another cryptocurrency token.

- Using cryptocurrency to pay for goods or services

- Gift and donation of cryptocurrency to another person or charity.

Tax Reporting

The calculation of a company’s taxable profits must be undertaken in the company’s functional currency, i.e. generally pound sterling for UK-based companies. The conversion basis used should be appropriate and consistent. Companies are subject to Corporation Tax on their profits and gains. Therefore the gain or profit from cryptocurrency activities should be reflected in the financial statements of the business. Financial reporting and Corporation tax reporting will follow the company's reporting timeline based on the financial period of the company.

This section is provided by Shukry Haleemdeen Founder of MyCryptoTax a UK firm specializing in all aspects around taxation and reporting of crypto currencies.

Tools to help with your company’s crypto tax declaration

There are an increasing amount of companies or services that help you with the taxation of crypto. Generally speaking there are two types of services: tax calculators and cryptocurrency accounting tools.

Tax calculator or portfolio management tools let you connect your company’s bitcoin wallet addresses and crypto exchange accounts to track the performance of your crypto assets in one place. You can then use your crypto trading history to automatically populate your country’s tax forms, required to report capital gains. The completed tax forms can be included with your tax return or easily imported it into your generalized tax software solution. Most of these tools also calculate unrealized gains and losses which assist with “tax loss harvesting” strategies, the act of strategically selling off assets at a loss to reduce your taxable gains.

Tax calculator tools: TokenTax, Zenledger, Taxbit, Cointracking.info

Accounting tools like SoftLedger or Cryptio on the other hand, are bookkeeping platforms which convert crypto transactions into usable data for accounting and finance. Cryptio connects your crypto exchange accounts to your company’s general ledger software and automatically tracks and labels every crypto purchase or payment in crypto. You can upload a chart of accounts and assign transactions to individual accounts. Once the transactions are classified, the platform generates standard files that most common general ledger tools will be able to import. SoftLedger is a full general ledger platform that was built specifically for crypto transactions. After connecting your crypto wallets and exchange accounts, the platform provides realized and unrealized gain and loss reporting with cost basis tracking.

Accounting tools: SoftLedger, Cryptio

Conclusion

All in all, the infrastructure around the buying, storing and accounting of crypto assets has matured a lot in the past few. Companies like MicroStrategy, Square and numerous funds have shown that investing into bitcoin is worthwhile and doable from an execution standpoint. We expect more and more companies to be interested in the logistics of buying bitcoin and other crypto assets and hope this article can provide some guidance.

Notice: cryptotesters does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.

Emanuel Coen

almost 2 years ago ·

14 min read

Latest Content

July 2022

Social network goes 3.0

July 2022

Azuro Protocol: Can the betting industry...

April 2022

Polynomial The New DeFi Derivatives Powe...

March 2022

Courtyard: Bringing Billions of Dollars ...

February 2022

The Rise of Music NFTs - Will this unlea...

January 2022

Deep dive into Perpetual Protocol v2

January 2022

Deep dive into Treasure DAO

January 2022

Why you should use Cowswap for all your ...

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials