A Beginners Guide to Crypto Investing

Emanuel Coen

over 1 year ago ·

12 min read

In the last couple of weeks, we received hundreds of questions about crypto, from curious people new to the space - friends, family and strangers on the internet. One of the most common questions we receive is: which cryptocurrency should I buy as an investment?

From the hundreds of cryptocurrencies being listed on sites like Coingecko, very little distinguishes them in the eyes of most novel investors. Understanding these differences and the market in general in-depth, requires countless hours of research and a fair amount of technical/financial understanding. Something that can simply not be expected from everyone.

We want to make sure everyone has a sturdy framework to evaluate cryptocurrencies so they don’t get sucked into scams and bad investments.

Basics: What different types of crypto assets exist?

When people talk about ‘cryptocurrencies’ they often mean different things. It’s common for instance to hear people refer to stablecoins like USDC or DeFi tokens like Maker or Aave as ‘cryptocurrencies’.

In reality crypto assets differ widely.

Cryptocurrency

*The main native asset of a base chain that serves as the default currency and serves a special role in the network it supports. At the very least it is needed to pay for transactions on the network (and more in some cases as we’ll see later). This revenue goes to a decentralized set of validators who secure the network. For the Bitcoin blockchain that currency is bitcoin (BTC) and for Ethereum it is ether (ETH). *

Crypto tokens

A token on a blockchain such as Ethereum can be programmed in infinite ways and theoretically represent any asset class - a fiat currency, bond, stock or even a commodity.

Tokens on Ethereum are like legal contracts. Instead of being written on paper and enforced by judges, these contracts are written in code and enforced by the Blockchain. Financial assets are nothing other than contracts between two or more parties.

A stablecoin such as USDC for instance, is stable because its issuer Circle, guarantees that it holds an equivalent amount of dollar reserves in bank accounts so that users can always redeem their stablecoins against ‘real dollars’.

Another company might decide to issue stock on the Blockchain - in which case the token cash flows, voting rights and everything else that you would commonly associate with a stock. There are rumours that the crypto exchange Coinbase, will issue part of its stock on Ethereum when it goes public later this year.

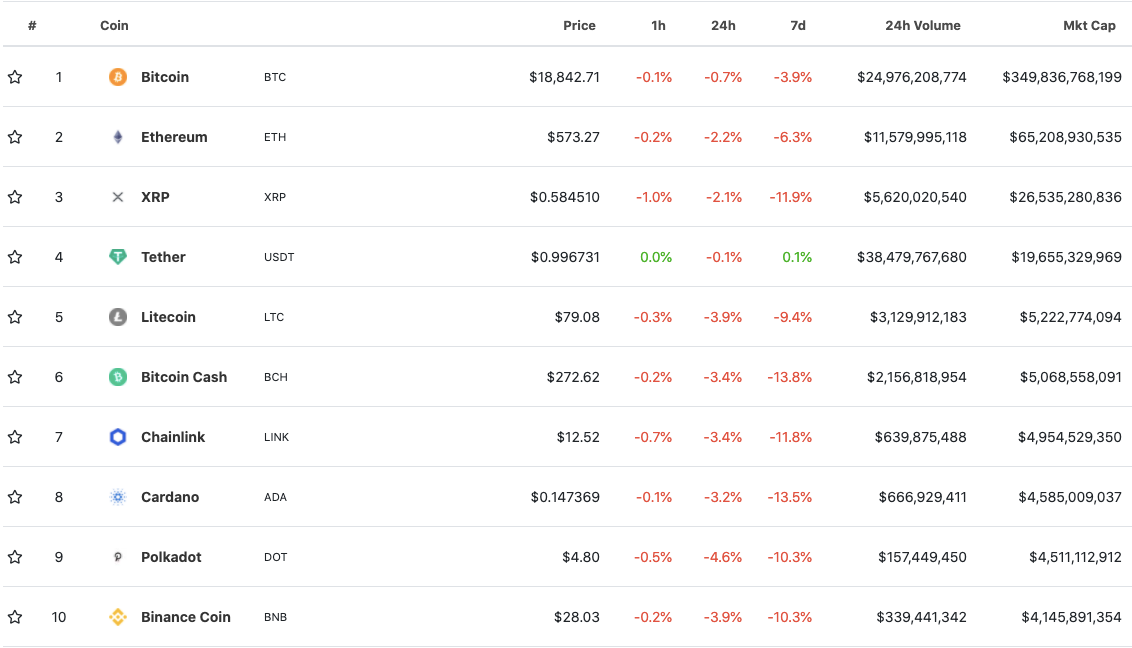

The Top 10 Cryptoassets by Marketcap as seen on Coingecko

As we can see, most assets on the image above are cryptocurrencies, according to our definition from before. With a few exceptions, they represent separate networks all competing for market share.

How can these Cryptocurrencies be compared?

To answer this question let’s ask ourselves, what is the purpose of a cryptocurrency and what scenario needs to happen for a cryptocurrency to be adopted and ultimately become “successful”?

Is the Blockchain decentralized and why does it matter?

A Blockchain is essentially a very inefficient type of database architecture. A centralized database controlled by a single actor or company is much, much cheaper for storing and updating transactions. If we look at payments for example, PayPal can process 100x more transactions per second than the Bitcoin network. But Blockchains have one advantage that centralized databases will never have - they’re decentralized!

Unlike with PayPal, no single company or government can control which transactions will be validated nor decide to take away or freeze a user's assets. The network functions according to its own logic which all network participants (wallets, miners etc.) have to follow. A sufficiently decentralized Blockchain can not have a sudden outage like for example Google or Slack have sometimes. Being decentralized makes a network robust.

The fact that it is decentralized means that anyone can join the network - be it as a user or a miner/validator. There are no gatekeepers and no single actor with a privileged status. A blockchain, much like the internet, is global, neutral and decentralized by definition. Imagine, if the internet was controlled by the United States: rivalling countries like China and Russia would never have adopted it and started building businesses on top of it. Neutrality fuels global adoption.

Does the Blockchain have network effects?

Network effects are a phenomenon whereby increased numbers of people or participants improve the value and utility of something. Let’s look at Facebook as an example. From a technological standpoint it would be easy for a competitor to clone the Facebook app. What makes Facebook valuable are its 2.7 Billion users. A social network without your friends, knowledge of your interests and pictures is worthless.

It turns out that the same holds true for crypto networks. Bitcoin has more than 200m “users” according to conservative estimates.

This means that as a new user you can send bitcoin to over 200m people who are already part of the network and understand and accept bitcoin as an asset. As we know from history, the perception of what constitutes a valuable medium of exchange is derived from social consensus. There used to be a time where people accepted clams as money, then gold and later bank notes issued by governments (a.k.a fiat currencies).

Within their respective networks, bitcoin and ether are viewed as money and the more people join the network and share this view, the more valuable these assets become.

But network effects are crucial in crypto networks for far more reasons. For a Blockchain to be credibly neutral it needs to be sufficiently decentralized. This is measured by how many nodes store the data and how many actors take part in the transaction validation process. In the case of Ethereum, there are currently 11.000 nodes distributed over the whole globe and new ones joining every day. As long as the data of the Ethereum ledger lives on so many different computers, it is virtually impossible to take it down.

And lastly, network effects are of utmost importance in order to attract developers to build on top of these public networks. To use the internet analogy one more time: would the internet be as valuable as it is, if there weren’t tons of useful applications built on top of it? From low-level applications like internet browsers to allow users to access the network to actual applications like Facebook or Youtube for people to use the network.

In the crypto space, developers are needed to improve the network, develop crypto wallets that end-users can use to access the network, and build other applications which facilitate actions like trading, lending and borrowing of crypto assets.

The collective effort of developers building one the same public network is incredibly powerful and more productive than the effort of any single corporation. When developers join a new network they look at which ones have an existing ecosystem of tooling.

Building an application on the internet today is fairly easy, most components that go into it are readily available: user authentication systems, SMS alerts, databases, payments etc. Developers don’t want to reinvent the wheel every single time they build a new app, they want to bring their idea to life quickly. By far the most mature developer ecosystem in the crypto space exists on Ethereum, where more than 2500 developers build applications every month.

Does the native cryptocurrency of the Blockchain capture value?

Perhaps the most important question to ask yourself when deciding to invest in a specific cryptocurrency is: what is my investment thesis for that asset? What scenario would need to happen for that cryptocurrency to become valuable. You don’t need to establish your own thesis, it can be someone else's which you read online, but simply hoping that an asset will appreciate given there’s enough hype around it will probably not do the job.

In absence of good network economics, a network’s native token can not appreciate regardless of how much the network is used. The same holds true for almost any asset: copper is a commodity that is used in almost all electronic devices and yet its price remains remarkably constant. Usage alone doesn’t make an asset valuable. However, a combination of sustained demand, scarce supply or some inherent cashflows being produced by the asset, (example later!) can do it!

The case for Bitcoin: “Digital Gold”

Bitcoin was the first cryptocurrency to come into existence. As such it benefits from a big lead in terms of brand recognition, adoption and network effects. At the time of writing it has a market cap of $336 billion. While it is hard to know for sure how many people hold and use bitcoin, as participants in the network are not identified, conservative estimates range between 100-200m.

At its core, Bitcoin is a decentralized peer-to-peer network, which allows to send bitcoin to any other participant in the network without any intermediary being able to censor the transaction. Any transaction which originates from a bitcoin wallet, gets examined by a collective of bitcoin miners. If the transaction is rightful it gets validated.

One of the most important properties of Bitcoin is its supply, which is hard-capped at 21 million bitcoins. This supply policy can not be changed by any single actor in the network. Today there are close to 19 million bitcoins. Every block ( on avg. 10 mins), a lucky miner who is able to validate user transactions’ before all other miners receives a reward of 6.25 bitcoins. Every 4 years the so-called ‘block reward’ is halved until the year 2140 is reached, at which no new bitcoins will be issued.

This fixed supply makes bitcoin a good store-of-value. In other words, an asset that will hold its purchasing power through time. Fiat currencies like the dollar or the euro are controlled by one single entity, which can print more dollars or euros at will. Confidence in a fiat currency rests on trust in the government (e.g., to wisely manage their monetary policy).

This is why people have turned to gold for centuries whenever economic instability and inflation loomed in the air. In many countries around the world these conditions are the norm and the need to protect oneself against it is always present.

Contrasting fiat currencies and gold, we can think of the US Dollar as a centralized monetary asset, which can be devalued by a single actor, and gold as a decentralized monetary asset, which cannot.

Now let’s see why bitcoin is compared to a digital form of gold:

-

Hard to mine: In the Bitcoin network miners have to put computing power to use in order to validate transactions. The process is both hardware and energy intensive.

-

Digital: bitcoin is a purely digital asset, it’s cheaper to store and easier to transfer than gold (e.g in 2013, it cost the german government $7.6m dollars to bring home gold reserved that it had stored in the US)

-

Instantly verifiable: The authenticity of a bitcoin is automatically verified by the network Bitcoin is cheaper to store and easier to transfer than gold

-

Censorship resistant: No government can decide to seize someone’s asset. Assets stored in a bitcoin wallet are unattainable by anyone but the owner holding the private key

-

Divisible: One bitcoin can be divided in 100 million smaller units (“satoshis”).

As we have mentioned earlier, what constitutes a good store-of-value is somewhat defined by social consensus. Right now, an increasing amount of people think that bitcoin will be a good store-of-value in the next decades. Especially younger demographics seem to feel estranged by gold and prefer bitcoin. But also institutions like Fidelity, Visa, JPMorgan are starting to voice their enthusiasm for bitcoin. Publicly traded companies like Square and Microstrategy bought bitcoin as a means to diversify their balance sheet.

The case for Ethereum: “An internet based financial system”

Ethereum shares many characteristics with its predecessor bitcoin. Like bitcoin Ethereum is a blockchain that is run by a decentralized network of miners. But instead of only storing who owns what, Ethereum has an additional component that differentiates it: creation.

The tool allowing developers to create things on Ethereum are called “smart contracts”. Smart contracts are programs that execute according to specific rules. Once deployed to the Ethereum Blockchain, these smart contracts can be used by anyone in the world, without any intermediary being able to interfere.

The most popular use case for Ethereum’s smart contracts are Decentralized Finance (DeFi) applications. DeFi applications enable users to do all the things that they would typically do with a bank or other financial institution - like trading, lending and borrowing - on the Ethereum blockchain. Collectively these applications are holding and managing more than $19B in user funds - in not even two years and without a single bank being involved.

DeFi applications are open-source and managed by communities, who collectively decide how to further develop them. This financial system has the capacity to be completely decentralized and trustless. For users in emerging countries with high inflation, this means they can suddenly buy stablecoins (dollar tokens), invest, earn interest, trade them or send them anywhere in the world within minutes.

This new financial system needs a native money to operate. The same way the US economy needs the US dollar to denominate taxes and as legal tender and to buy things in stores, Ethereum’s native asset is ETH. For any type of transaction, users have to pay a small transaction fee known as gas, which is denominated in ETH. One can see Ether as a share in the network: the more applications are built on top of Ethereum, the more valuable the asset will become.

Anytime an asset is moved, a loan generated, a purchase is made or a new on-chain cooperative is deployed, Ether is being consumed and goes to miners. Users need to buy ETH to make transactions, the same way people need to buy fuel in order to use a car. Fee revenue matters as ultimately it pays for the security of the network.

Fee Revenue by Cryptofees

Ethereum generates more transaction fees than bitcoin. No other network even comes close to Bitcoin and Ethereum in terms of usage and transaction fee revenue. Most other projects listed in the screenshot above are applications built on Ethereum. They make the Ethereum economy more useful and valuable. Networks like Ripple only come at the 17th spot although their valuation would imply a lot more.

As of now, these miners can sell their earned ETH back on the market so there’s no direct relationship between usage and ETH price appreciation, but in the very near future, a new policy will be implemented that will burn a small portion of all the ETH paid as transaction fees effectively making ETH **a deflationary asset ** (one that shrinks in supply).

Lastly, ETH is currently undergoing a transformation from Proof-of-Work (mining) to Proof-of-Stake (staking). The primary motive of this transition is for Ethereum to become more scalable and process more transactions, but as a secondary effect, Proof-of-Stake also makes ETH more valuable.

In Proof-of-Stake, transactions are not validated by miners who have to spend computing power to solve an algorithm but by validators who vote and lock up capital (32ETH per validator node). If they vote maliciously their stake is slashed, if they vote correctly they receive ETH rewards. This means that ETH is now also a capital asset, like a bond, that when staked, generates regular cash flows. Under proof-of-stake there is hardly any incentive for validators to sell their ETH. Instead they want to accumulate more ETH in order to deploy more validator nodes and earn more cash flows.

Although we are only in the Phase 0 of this transformation, which will take 1-2 years to complete, there is already more than $1b dollars worth of ETH staked.

All these different utilities combined make ETH an extremely interesting asset from an investment point of view. By buying ETH you are buying a share in a protocol similar to the internet. What the internet did for information, Ethereum is doing for finance. It is the financial internet.

Conclusion

When you look at which cryptocurrencies to buy, take into consideration how decentralized a network is, how many people use it, how much utility it provides and how its native token is designed to capture the value from all the activity going on on its network.

In the case of Ripple for example, which we mentioned at the beginning, you will realize that the majority of the tokens are owned by Ripple Labs, a centralized company. Moreover, you will realize that the network is not decentralized at all and that XRP, the native token of the Ripple Network, has no utility at all.

If the cryptocurrency doesn’t fulfil any of the criteria above it is most likely that it doesn’t need a blockchain and is only using the “cryptocurrency” label for marketing purposes.

If you want to find out where to buy cryptocurrencies like Bitcoin or Ether check out our list of cryptocurrency exchanges or hop into our Telegram community.

Emanuel Coen

over 1 year ago ·

12 min read

Latest Content

July 2022

Social network goes 3.0

July 2022

Azuro Protocol: Can the betting industry...

April 2022

Polynomial The New DeFi Derivatives Powe...

March 2022

Courtyard: Bringing Billions of Dollars ...

February 2022

The Rise of Music NFTs - Will this unlea...

January 2022

Deep dive into Perpetual Protocol v2

January 2022

Deep dive into Treasure DAO

January 2022

Why you should use Cowswap for all your ...

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials